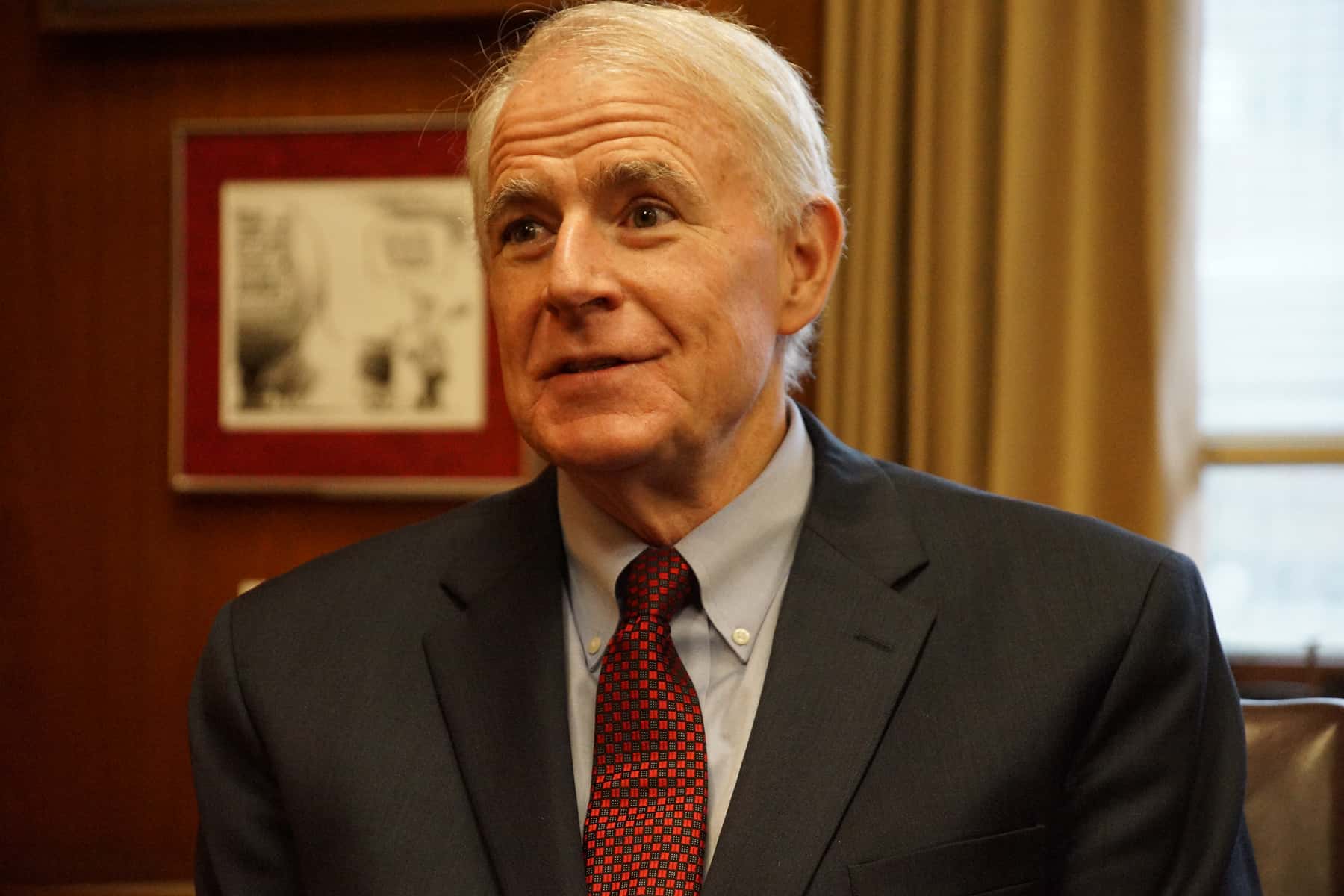

Mayor Tom Barrett presented his 2020 proposed executive budget to Common Council members on September 24.

The Finance & Personnel Committee of the Common Council will hold hearings on the Mayor’s Proposed 2020 Budget beginning October 4. That will be followed by a joint public hearing with the Mayor and Council about the budget on October 7, where residents can share their views on the City’s finances and proposed 2020 spending.

The Common Council is scheduled to adopt the City’s 2020 budget at a special meeting on November 8.

Mayor Barrett’s 2020 Executive Budget Address, as as delivered on September 24, 2019

Thank you Mr. President.

Mr. President, Council Members — including the newest council member, Alderman Spiker —City Attorney Langley, Treasurer Coggs, Comptroller Matson – the city budget follows a defined schedule, a timeline laid out in law. So, in a way, it is predictable and familiar year-in and year-out. While that schedule repeats itself for the 2020 budget, the context and the content of this year’s budget are far from ordinary.

Here’s the biggest problem heading our way. By 2023, we will face challenges to the levy-supported budget that put us in an untenable situation. Our employer pension contribution, driven by public safety, is currently projected to rise dramatically. Our state shared revenue payment remains flat, certainly not keeping up with inflation. And, our costs of providing basic and necessary city services climb every year.

Council members, you know where we stand. In past budgets we have reduced costs and eliminated hundreds of vacant positions. Innovation has kept health insurance costs down. In fact, we’ve done a remarkable job with our health insurance. Partnerships with local not-for-profit agencies and businesses have kept us moving in the right direction. But, as you also know, state law restricts our property tax and service fees. State law also prohibits us from implementing other revenue sources.

The budget I present today includes difficult cuts throughout city government. At the same time, we will, as we’ve done in the past, produce a balanced budget. We will, as we have always done, make our payment to the pension system. In fact, with this budget I propose we will do more than that. To prepare for the anticipated pension contribution increase in 2023, I am proposing we set aside $8 million dollars to begin meeting that obligation.

But, even with these unprecedented pressures, City government will continue to provide the core functions that our residents expect and deserve. That means the snow will be plowed and potholes will be filled. Streets will continue to be repaved. We will respond to emergencies and protect the health and safety of our residents. And to provide these core services, we will be increasing the tax levy by 3.5%.

An average residential property will see property taxes climb about $37. Fees will be up about $22. So, a property taxpayer in that average home will pay about $59 more next year. Increases in property values also mean our property tax rate will actually decrease by a penny.

Now I hope we can all agree that nothing is more important than protecting our youngest residents. We have every reason to be proud of the reductions we’ve achieved in childhood lead poisoning. Since 2004, the number of kids with elevated blood levels is down over 70%.

My 2020 budget includes over $21 million to continue to reduce lead exposure. Over $8 million of that funding will go to assess and abate lead hazards in homes where children have been affected.

We will also provide safe home kits and education to families at risk in our most impacted ZIP codes. This budget has $13.6 million for lead service line replacement, testing, and filters for at-risk households. Over 1,000 properties will have their service lines replaced. Next year, working with home owners, and the state and federal government, our Health Department will nearly double the number of lead-abated homes.

But looking forward, the most formidable challenge before us is fulfilling our obligation to fund the city’s pension system. This deserves a little explanation. Until 2009, the city enjoyed an extended period in which no, zero, employer pension contributions were required. That changed ten years ago and, in the years since, our obligation has trended up – so currently we are contributing about $70 million dollars annually. I commend each and every one of you for supporting these payments.

But here’s the shocker – in three years, 2023, our required annual contribution could rise by almost $100 million. We have to prepare for that. That’s why I have included the $8 million payment to our pension reserve fund to help smooth the impending impact. That’s a necessary step, because if we wait until 2023, nearly all the increase would have to come from budget reductions that year.

One hundred million dollars — Obviously, I hope and pray we don’t reach that number. But, to reach that number, you’d have to entirely eliminate the budgets of the Health Department, Employee Relations, City Development, the Department of Administration, the Treasurer, Neighborhood Services, the Library, and the Common Council-City Clerk. And, even after eliminating all those departments, you’d still be millions short.

Now, our employer contribution is affected by several factors. The anticipated rate of return, the amount that we expect to make on our investments, is one of those. To bring us in line with accepted actuarial standards, the Pension Board — the independent Pension Board — reduced our anticipated rate of return from eight percent to seven-and-a-half percent. That brings us in line with other municipalities and state pensions. It actually doesn’t even reach where the state is, but it’s obviously a reduction. This is part of what is driving the higher required contribution.

What also drives our pension costs are the benefits received by sworn public safety employees. More than eighty percent of the estimated 2020 employer pension contributions are attributable to uniformed police and fire employees. That’s 80% of the cost for 44% of active employees in the pension system.

Now, these numbers are in no way a knock against our police and firefighters. I want to be clear: our public safety employees do a great job under challenging conditions. In fact, we should all be pleased that when we look at key crime statistics they’re down. Homicides are down. Non-fatal shootings are down. Robberies are down. Even with this success, the budget forces us, forces us, to take a hard look at the sworn staffing levels at the police department.

But, the reality is, our pension structure is not fiscally sustainable. Pension changes are required going forward. We need to move to a new benefit structure, one more akin to the state employee retirement system. We need stability – for our retirees, our current employees, our future employees, and of course for our taxpayers.

We also have to face a practical reality — and many of you have heard me talk about this before, but has to be said again. For the fifth consecutive year, the budget of the police department exceeds the entire property tax levy for the City of Milwaukee.

The budget for the Milwaukee Police Department exceeds the entire property tax levy for the City of Milwaukee. Not surprisingly, police and fire costs are the areas where we’ve seen the biggest increases. Next year, the increase in the police and fire budgets are larger than all other city departments combined. Why is that? In part because we have little control over those costs as result of state law. State law drives a lot of what we’re talking about here.

So, in my next budget you will see we are increasing the line item for police salaries. But, even with that increase in the police department budget, the sworn strength will go from 1,864 to 1,804. This is a reduction of 60 positions. We are not laying officers off. Any reductions come through retirements. This will have no effect on security plans for the Democratic National Convention.

This reduction is fiscal; it is not philosophical. In fact, if the state and our voters approve it, I have a plan to preserve these positions. A group of city and county officials have publicly promoted a locally-approved sales tax for Milwaukee County. Diversifying our tax revenue would be an important step forward and give us the increased ability to maintain the number of police officers, purchase equipment for the Fire Department, repair more roads, and provide additional protection from lead hazards that Milwaukee children face.

I recognize it’s an uphill battle, but we have to have an additional tool to allow us to help ourselves. Let me be clear: We are not asking the state for more money. We are asking for the ability to go to our voters and to address the pressing financial issues that we face.

Both the Metropolitan Milwaukee Association of Commerce and the Greater Milwaukee Committee are supportive of our efforts — absolutely supportive of our efforts. They understand the importance of Milwaukee controlling its own destiny, limiting cuts and providing property tax relief.

We need to go to referendum in April. With that, we could start getting the revenue we need later in the year. Given our needs, we have already started costing out what we can do with the sales tax revenue that we will begin collecting next year. It’s not part of this budget, but this is why this is pressing. And, I’ll tell you exactly how I would propose the money could be spent. We could eliminate the staff reductions to the police department. Instead of 60, it would be zero. We could provide equipment for the fire department and ramp up our efforts to fix our streets and abate lead.

Sales tax proceeds will let us expand our efforts to reduce threats from lead paint and replace more lead service lines. Funding from a sales tax would allow the Health department to offer assessment and abatement for up to 300 more homes a year, and provide nursing and case supervision to more children beyond what the federal government requires.

That funding could also increase lead service line replacements by up to 300 homes where children have higher blood lead levels and provide training to lead-safe workers and contractors for both home abatement and lead service line replacements.

I appreciate the work many of you have done to support the local option sales tax. I’m hopeful that this will add to our fiscal stability this coming year, and for the long term. Colleagues, I’m asking each and every one of you to understand the gravity of our situation and to focus on the big picture. Citizens, I ask you the same. Let’s work together to try to convince the legislature to allow our citizens to decide the level of services they need.

But, we know we have challenges in front of us. We face challenges that are larger than we have faced before. I need your help. Our residents need your help. The City is at a crossroads. We need all hands on deck, and that means each and every one of you. It’s about the future of the city we all love.

Thank you very much.