“The FHA viewed metropolitan growth with “black and white” vision in which race trumped all other factors in predicting the trajectory of a city and its neighborhoods.” – John Kimble

The fundamental tool used by Americans to build generational wealth and all the successes that come with, it is the ownership of land and property such as homes and businesses. The American dream since the 1930s has been wrapped up in homeownership. Many of the huge disparities we see today are a direct result of White people being given access to homeownership which fostered generational wealth building to the exclusion of people of color.

Many people make the argument that a lot of the disparities in our society have more to do with class than race. They are misguided. Race has always eclipsed class in this country. Being poor and White is not the same as being poor and Black, Latinx, Asian, or Native American. A majority of the poor people in the country are White because they represent the largest share of the nation’s population.

Whites are highly underrepresented in the percentage of those in poverty. Only 9 percent of Whites were living in poverty in 2019 (17,328,200 persons). Among other groups the numbers are as follows: 21.2% of Blacks (8,244,000); 17.2% of Hispanics (10,174,200); 24.2% of Native Americans (514,000). In total 39,383,200 Americans reached the income thresholds to be considered living in poverty. Whites are 60 percent of the U.S. population but just 44 percent of the poor. Blacks are 12.4 percent of the population but account for 21 percent of the poor. Hispanics are 18.4 percent of the population yet they are 26 percent of poor Americans. Native Americans are 0.7 of U.S. residents but are nearly double that at 1.3 percent of the poor.

When we look at median household income by race Asians have the highest income at $81,331. This is in many ways misleading because there are multiple groups of Asians in the country and some are simply not anywhere near this income range. According to Pew Research data:

“From 1970 to 2016, the gap in the standard of living between Asians near the top and the bottom of the income ladder nearly doubled, and the distribution of income among Asians transformed from being one of the most equal to being the most unequal among America’s major racial and ethnic groups…the gains in income for lower-income Asians trailed well behind the gains for their counterparts in other groups…Asians near the top experienced more growth in income from 1970 to 2016 than any other group while Asians near the bottom experienced the least growth.”

Immigration policies have played a major role in this shift among Asians. In 1965 major immigration reform was enacted which favored family reunification. After the Vietnam War ended in 1975 many southeast Asians immigrated to the U.S. Previously highly educated and highly paid Asian immigrant groups were replaced by more less educated and more poorly paid Asian immigrants particularly from 1970 to 1990. Another change in immigration policies, the passage of the Immigration Act of 1990 intentionally looked to bring more highly skilled immigrants to the country. Consequently, the newer wave of Asian immigration were primarily skilled wage earners in technology sector including many from India under the auspices of the H-1B Visa program.

Asians come from many different nations. The largest share of Asians are Chinese (24%), Indian (20%) and Filipino (19%). Vietnamese, Koreans and Japanese are each more than 5% of the Asian population in the country. The more recent immigration by Asians is spurred by other groups of Asians some of whom tend to fall alongside the lower earning side of the spectrum.

“Bhutanese (92%) and Nepalese (88%) have the highest foreign-born shares, followed by Burmese (85%), Malaysians (83%) and Sri Lankans (78%). At the other end of the spectrum, Hmong (39%) and Japanese (27%) have the lowest share of foreign born among U.S. Asians.”

According to Pew, “Four groups have household incomes well below the median household income for all Americans: Bangladeshi ($49,800), Hmong ($48,000), Nepalese ($43,500) and Burmese ($36,000). By contrast, Indian households have the highest median income ($100,000), followed by Filipinos ($80,000), Japanese and Sri Lankans (each $74,000).

Asians are the most highly educated Americans with over half of Asians 25 and older holding a bachelors degree as compared to just 30 percent of Americans in general. However this is not equally shared across all Asian groups. Once again Pew tells us that, “Indians have the highest level of educational attainment among Asian Americans, with 72% holding a bachelor’s degree or more in 2015. A majority of Sri Lankan (57%), Mongolian (59%) and Malaysian (60%) adults 25 and older have a bachelor’s degree or more. But lower shares of adults have a bachelor’s degree or more for Cambodians (18%), Hmong (17%), Laotians (16%) and Bhutanese (9%).

Median Household income among Blacks overall is the lowest in the country at just $40,258. Hispanics had a median household income of $50,486 in 2018. White median household income was $68,145.

Among Hispanic immigrants, Pew data shows a different educational attainment level than among Asians. “The Hispanic immigrant population tilts to the lower end of the education and income distributions. In 2015, 47% of foreign-born Hispanics ages 25 and older had not graduated from high school, compared with 13% of Americans overall. And only 11% of Hispanic immigrants had attained at least a bachelor’s degree.

Now shifting to look at how all of this plays out requires a look at what allows higher levels of educational attainment. College attendance and completion is aligned with family income. Conversely family income is aligned with generational wealth building and access to the American dream.

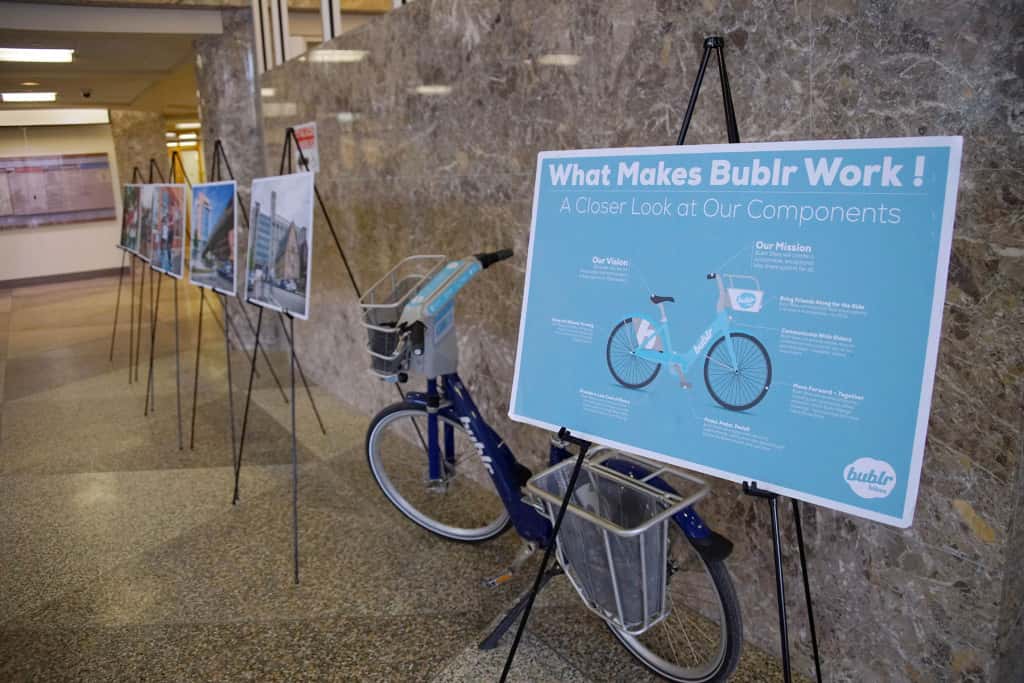

For decades the Federal Housing Administration played a major role in Whites gaining access to that dream and turning it into a nightmare for Blacks. In 1934, concerned with a 50 percent foreclosure rate due to the Great Depression and a need to spur employment the federal government under President Franklin Delano Roosevelt (FDR) created the Federal Housing Administration (FHA). They were supposed to play an advisory role in increasing homeownership opportunities but eventually created policies which drove White homeownership while intentionally worked against people of color having the same chances at buying homes.

They did this in two ways. They helped to create the amortized mortgage, significantly lowering downpayment, lowering interests rates and extending mortgage terms to twenty years from the traditional 3-5 year mortgages. By making mortgages more user friendly they hoped to convince Americans to become homeowners. Another factor at the time was a desire to convince Americans of the power of capitalism at a time when socialists movements in the country were very influential.

The FHA began to insure mortgages by backing the loans with promises of repayment in cases of defaults. From 1930-1950 ninety-eight percent of all FHA backed loans went to Whites. People of color had been largely shutout of wealth building through homeownership and the growth of equity. Most Blacks who purchased homes were forced to use land contracts, essentially a pay as you go system which built no equity and risked a loss of all previous payments made by missing or being late even one time. By defaulting on land contracts, they lost years of payments and were foreclosed on or made to start over from scratch.

In 1950, most of the 28,000-plus traditional bank mortgages in the city of Milwaukee were held by Whites, with people of color holding only 369 of those mortgages. FHA and Veterans Administration loans, totaling over 8,000 in Milwaukee were all held by Whites. So while White families here and across the country were buying homes which gained value over time, growing equity used to help them get through difficult days and sending their children to college and making improvements to their primary residences, vacation homes, and investment properties. This allowed them disposable income to pay for large weddings, and investments in stocks and bonds. The mortgage deduction on their taxes was an added benefit which saved tens of thousands in taxes paid over the course of time they paid off their homes as well as the real estate tax deduction.

This decades long accumulation of wealth is why we see a huge gap in wealth across racial groups today. Higher rates of college attendance accrued from the policies as well. Public schools funded by property tax revenue allowed whites to attend more well funded schools in suburban communities around the country. At the same time, poorer Black and Hispanic big city communities suffered as Whites fled to newly built suburban communities and subdivisions which excluded all but White residents.

The ensuing wealth gap meant that people of color would struggle to keep up with their White peers. So despite this, people want to talk about class being so important in inequalities. The system was rigged so that much fewer Whites would ever be in the lower income groups and people of color would struggle mightily to not fall into those groups.

Like the old question about what came first the chicken or the egg, if class is the chicken and race is the egg, the egg came first. Race has always been more important than simply class in building inequality in America.

If the playing field had been level then we would not see such huge disparities in homeownership nationwide between Blacks (44%) and Whites (72%). In Milwaukee just 27.2% of Blacks own their homes, only Minneapolis is worse (25.2%). Due to ongoing segregation only 24.4% of Black families inMilwaukee earning over $100,000 lives outside the central city. Only Jacksonville at 19.2% is worse of the fifty largest metro areas in the country. By contrast the percentage is: 57.4% in Chicago; 66.5% in Detroit; 68.2% in Pittsburgh; Portland, that number is 61.3%; 73.4% in Cleveland; 74.3% in Baltimore; 75.8% in Minneapolis; 89.1% in San Francisco according to Mark Levine of the UW-Milwaukee Center for Economic Development.

These long-term racist practices have flipped any attempt to argue that poverty and class arguments are somehow separate from the impact of race. Race matters more than class now as it always has in America.

“What made America distinctly American for them was not simply the presence of unprecedented opportunities, but the struggle for seizing these opportunities in a new land in which black slavery and racial caste served as the floor upon which white class, ethnic, and gender struggles could be diffused and diverted. In other words, white poverty could be ignored and whites’ paranoia of each other could be overlooked primarily owing to the distinctive American feature: the basic racial divide of black and white peoples. From 1776 to 1964… this racial divide would serve as a basic presupposition for the expansive functioning of American democracy, even as the concentration of wealth and power remained in the hands of a Few well-to-do white men.” – Cornell West, “Race Matters”

© Photo

Library of Congress