Brandon Cacek filed for unemployment insurance in mid-March last year after losing his substitute teaching job due to the pandemic. He is still waiting for that crucial aid 11 months later.

“I keep leaving out hope that I’m going to get some kind of assistance through this,” said Cacek, 40, a Marine Corps veteran and father of two in Marinette, Wisconsin. “But the longer this goes on the less hope that lingers.”

Nearly every person who has reviewed Cacek’s case has found no reason to deny him compensation, he said. That includes an administrative law judge who ruled on Dec. 28 that Cacek qualifies for benefits dating back to March 5.

But Cacek remains stuck on an obstacle course that has kept thousands of Wisconsinites from quickly receiving compensation after losing work as the Wisconsin Department of Workforce Development wades through a record number of claims during the pandemic. The crisis has exposed a hopelessly antiquated computer system that literally cannot answer phones and print compensation checks at the same time.

Even after the judge ruled in his favor, Cacek was advised to hold off on claiming two additional weeks of payments for fear that amending his initial claim would spur another department review, he said.

“I’m seriously not in a position financially for any further delays,” Cacek said. “I’m losing all credibility with my creditors. I got nothing left.”

Democratic Governor Tony Evers and the GOP-controlled Legislature have spent months blaming each other for the agency’s shortcomings as they stalemate in addressing many of Wisconsin’s challenges. In January, Evers called a special session of the Legislature to overhaul the state’s unemployment system. The Legislature gaveled in as required by law, only to immediately adjourn until Wednesday, when it advanced a bill to start the process of replacing the state’s antiquated claims system.

The Evers administration largely attributes DWD’s shortcomings to its antiquated, inefficient computer system for processing claims — relying on 1970s-era technology that previous administrations never upgraded. Republicans agree that Wisconsin should replace the system, but questions loom about how and when the state will pay for it.

Labor experts say such an overhaul would take time, and that Wisconsin could take additional steps to more quickly repair its torn safety net. Those include making filing claims more user-friendly — as other states have done during the pandemic — by waiving restrictions Republicans enacted last decade to limit access to benefits.

The extra red tape is tripping up legitimate claimants and slowing down processing systemwide, said Victor Forberger, supervising attorney for the University of Wisconsin’s Unemployment Compensation Appeals Clinic.

“There are now errors popping up all over the place. Those errors now have to be corrected,” Forberger, who has represented Cacek and dozens of other struggling claimants during the pandemic, told a state Senate committee last month. “And that’s leading to more administrative sludge. It’s making it harder to get things fixed.”

Old technology ‘a complete shock’

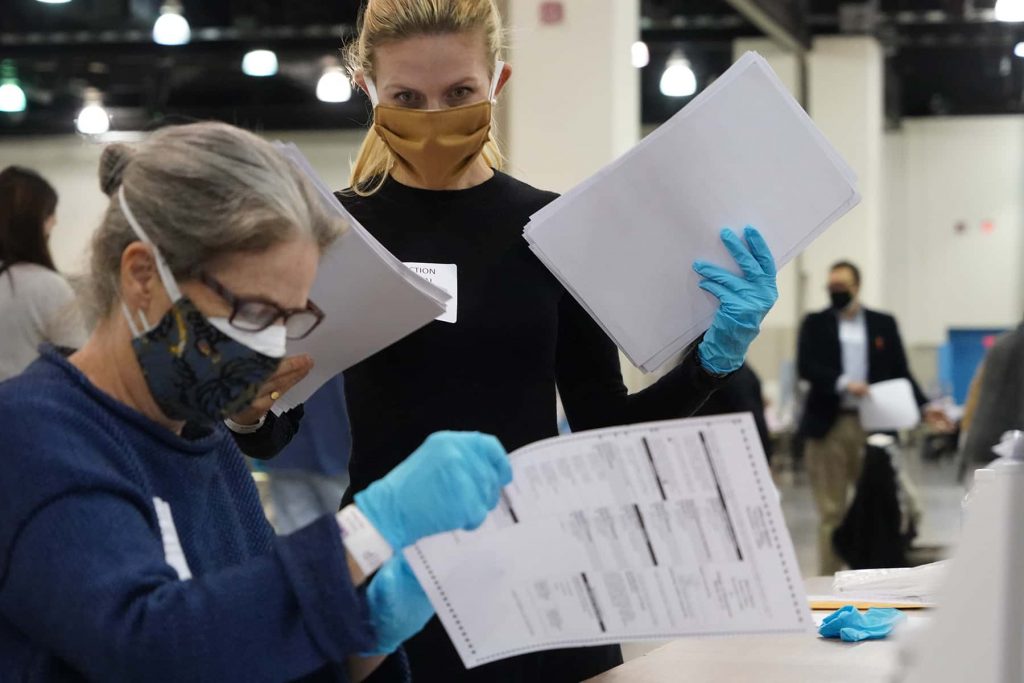

DWD Secretary-designee Amy Pechacek — who replaced her ousted predecessor in September — said she was in “complete shock” when she discovered how inadequate Wisconsin’s claims processing technology is. Pechacek made those comments in January as her department offered reporters a glimpse of the state’s slow-moving and confusing system.

The department’s IT system requires sequential testing and programming, meaning that new benefits programs — such as those adopted by Congress during the pandemic — must be programmed one at a time, adding months to claims processing. The flood of claims in 2020 required DWD to rehire retired employees who knew COBOL, a 60-year-old programming language rarely taught outside of behind-the-times state agencies.

The system cannot perform multiple tasks at once, said Neeraj Kulkarni, DWD’s chief information officer. The state’s unemployment help center, for example, must stop taking calls by 5:30 p.m. daily so software can begin writing checks to claimants by 6 p.m., Kulkarni said — a major hurdle to carry out Republican lawmakers’ push to expand call center operating hours.

Congress’ temporary expansion programs add further stress to the system, said Adam Nisporic, a benefits supervisor for the department. DWD manually adjusted more than 250,000 claims in 2020 — more than quintuple amounts from some more typical years, Nisporic said. His team shifted from 16 full-time staffers before the pandemic to 140 — part of a broader DWD expansion that cost taxpayers tens of millions of dollars. The creaky technology pushed at least one adjudicator to quit.

“It was all a big mess,” said John, who said he briefly worked for the department through Alorica, an international work-at-home customer service contractor. He asked for his last name to be withheld so as not to jeopardize future employment.

John described a system requiring multiple logins, toggling between various portals and “really, really old school” software. After two weeks of training in January, John said he was given 10 cases to work on while under supervision. He quit the next day, saying the hassles weren’t worth the $16 hourly wage.

DWD says replacing the claims system would cost up to $90 million, and in his two-year budget announced Tuesday, Evers asked the Legislature to earmark $79.5 million for the project.

Instead, Republicans want Evers to first find money himself. Returning to Evers’ special session on Wednesday, the powerful Joint Finance Committee cleared legislation that would require DWD “to seek and exhaust any federal funding available to use for the project,” before requesting funds from lawmakers. The bill needs approval from the Assembly and Senate before landing on Evers’ desk.

Calls for more fixes

But software upgrades won’t fix everything, as other states have learned. Michigan’s technological overhaul a decade ago resulted in false allegations of fraud against tens of thousands of claimants — leaving many in financial ruin. Agency staffers did not verify whether the automatically flagged claims were actually legitimate. That same system backlogged early in the pandemic.

Rachael Kohl, director of the University of Michigan Law School’s Workers’ Rights Clinic, called Michigan’s unemployment system upgrade a “double-edged sword.” She credited the modernized system with easing the rollout of new benefits programs such as those enacted last year by Congress. But, Kohl cautioned, upgrading technology without paying close attention to programming can lead to disaster.

Making claims filing simpler also averts filing mistakes that slow down processing, Kohl said. Wisconsin’s DWD says it was addressing that issue. In December, it announced a plan to simplify application language, although Forberger contends that the proposed changes don’t go far enough.

But even more helpful for Michigan’s jobless, Kohl said: Governor Gretchen Whitmer’s series of executive orders which, among other things, temporarily waived a requirement that officials investigate every job separation in the 18 months before a claimant files.

The waiver lasted just months, however, before a Michigan Supreme Court ruling in October invalidated Whitmer’s orders. Before the ruling, the Michigan Unemployment Insurance Agency “only had to get information from the (current job separation) causing the unemployment benefits to be able to move forward on the claim,” Kohl said. “So that was a huge way to remove the backlog in the system.”

Whitmer, a Democrat, later forged a deal with the Republican-controlled Legislature to restore some, but not all of the unemployment provisions invalidated by the court ruling.

Forberger, the Madison attorney, testified at a Senate committee hearing last month that Wisconsin should start the years-long project to modernize its claims system, but doing so is “not going to fix anything right now.”

Waiving Walker-era restrictions?

The pandemic struck about a decade after Republicans under Governor Scott Walker toughened rules for accessing unemployment insurance in the name of limiting fraud and saving money.

Wisconsin and other states began to limit access to jobless compensation after a flood of claims during the Great Recession forced them to borrow from the federal government to keep their unemployment trust funds solvent. Under that transformation, states required claimants to clear a series of bureaucratic hurdles to prove they weren’t committing fraud — rather than starting with a presumption of innocence, labor experts in Wisconsin, Michigan, New Jersey and Florida.

An April New York Times analysis found that all but seven states shrank the percentage of laid off workers receiving benefits between 2007 and 2019. Wisconsin saw about 50% of its jobless receive benefits in 2007; that shrank to just 30% in 2019.

“The (Walker) administration’s goal was to turn unemployment on its head and they succeeded,” Forberger said in an interview. “The whole point now is to deny the claim.”

Wisconsin’s trust fund balance stood at about $1 billion in early February. That’s down from nearly $2 billion before the pandemic struck, but far better than funds for the 18 states now borrowing from the federal government to pay unemployment insurance.

Disability changes delay payments

Walker’s changes included a 2013 Wisconsin law disqualifying people on federal disability — which currently pays an average of $1,277 per month — from accessing state unemployment compensation when they lose part-time work. Critics say the ban discriminates against people with disabilities.

That was what first tripped up Cacek when the pandemic cost him his substitute teaching job. Cacek experiences seizures that limit him to part-time work, allowing him to receive federal disability aid since 2017. DWD initially applied the ban not only to regular unemployment insurance, but also to Congress’ pandemic compensation, which Cacek sought. The agency reversed course in July. That allowed disability recipients to collect the temporary federal aid, but the agency has slowly processed those applications.

DWD then denied Cacek’s claim, which could be related to confusion over one question on the application, he was told. He is not alone: DWD has taken months to determine many claimants’ eligibility for federal aid. Cacek then waited four months for DWD to schedule a hearing to appeal his denial, leaving him in limbo with thousands of other Wisconsinites appealing denials.

He and his wife are surviving on a collection of small income streams as he waits on DWD. She also receives some disability assistance and earns a few dollars providing child care for the couple’s neighbors. A few thousand dollars in state rental assistance and federal stimulus checks have helped the couple stay in their home; a veterans program called Heat for Heroes has helped with utilities. Cacek also collects empty cans for cash.

Without new legislation, Wisconsin’s roughly 175,000 people who receive federal disability assistance will remain ineligible for unemployment insurance once the pandemic ends. Evers’ budget proposes to repeal the restrictive 2013 law. Other Walker-era restrictions include increased work search requirements for aid recipients. Confusion surrounding those and related requirements often kicks claims into adjudication, which DWD says takes 21 days on average to resolve.

Pandemic prompts rule waivers

Several states have cut their workload by waiving such rules during the pandemic, Forberger said. Changes that could simplify processing in Wisconsin, he said, include eliminating requirements to: register with the Wisconsin Job Service, attend a re-employment services training and declare an “able and available” status for full-time work each week.

The agency could also extend deadlines to file appeals and submit reports, investigate only the most recent job separation of a claimant rather than 18 months of work history and make it easier for businesses to avoid charges to their unemployment accounts due to pandemic-related layoffs, Forberger said.

The Legislature did temporarily waive Wisconsin’s work search rule, and DWD extended the waiver this month. But the state still requires claimants to register with the Wisconsin Job Service and attend training.

Meanwhile, Wisconsin’s one-week wait for benefits, another Walker-era restriction, disqualifies it from collecting a $1.3 million weekly federal reimbursement for unemployment under Congress’ stimulus. State lawmakers waived the waiting period in April, but the waiver expired on Feb. 6. The Legislature included a fresh waiver in legislation that Evers vetoed this month. That wide-ranging bill would have also limited Evers’ emergency powers and given the Legislature control over federal COVID-19 relief funds — among other provisions Evers opposed.

DWD announced Wednesday morning that it had taken “the first step” toward waiving the waiting period through an emergency rules process. And the Republican-led Joint Finance Committee proposed its own temporary waiver — through March 13 — in the legislation advanced Wednesday afternoon.

Evers’ budget calls for making unemployment claims “less complicated” and to expand eligibility and speed the processing. The proposal would permanently eliminate several restrictions, including: the one-week waiting period, a maximum earnings threshold to qualify for benefits and work search requirements. But Assembly Speaker Robin Vos, R-Rochester, said his colleagues may “start from scratch” on their own budget.

Fraud fears add delays

Like thousands of others, Amy Moreland, 38, waited weeks to see extra federal aid added to her modest unemployment benefits after losing work in March. But the former Madison bartender and events coordinator had little trouble with the state’s filing system itself. She briefly returned to work during the summer when bars opened for outdoor seating, but she was again laid off in November as cold weather arrived.

After one go-around with filing for unemployment, Moreland expected to file a second claim without a hitch. But two weeks into her payments, DWD placed a hold on her account — the same one she had been using throughout the pandemic — until the department could verify her identity. After multiple calls, she was told to await a call from the fraud department.

“I have a state REAL ID. I have my birth certificate. I have my Social Security number. I have my passport. I have everything that I can to prove that I am me, and it doesn’t matter,” Moreland said in late January.

A variety of fraudsters have targeted state unemployment systems during the pandemic, including Wisconsin’s. The U.S. Department of Labor’s Office of the Inspector General cautioned that at least $36 billion in federal unemployment relief could have been paid improperly through Nov. 7, with much of that going to fraud. DWD issued six fraud warnings to Wisconsinites receiving unemployment last year.

Fraudulent claims historically make up just 1% of Wisconsin claims, Pechacek said, acknowledging that it and other states are increasingly seeing fraudsters seek a cut of federal pandemic relief. A Google partnership has helped DWD to flag suspicious activity such as claims coming from international IP addresses or multiple claims filed under multiple names but the same bank account number, Pechacek said.

On February 3, Moreland said a caller from DWD informed her that someone in Kentucky tried to access her account, and the system locked the account immediately.

“Ideally it would be like when the bank sees suspicious activity on your account and then they lock it and call you,” Moreland wrote in an email. “So the first part happened (they locked it), but the 2nd part just took 13 weeks I guess.”

She finally received $1,100 in her bank account on Feb. 3. She and others expect to wait several more weeks for DWD to program its IT system and deliver the supplemental benefits Congress approved in December.

During her wait, she enrolled in an online social work program at Madison Area Technical College, living off of student loans. She knows the loan debt could offer future headaches.

“But right now I just have to do what I can to survive,” she said.

In Marinette, Cacek said he’s staying busy as his wait for compensation nears a year. That includes helping his children navigate online middle school. He noted proudly that one of them made the honor roll last quarter. Cacek also makes delivery runs for his local food pantry and helped organize a gift drive for local children at Christmas. The time away from work also allowed him to get much-needed back surgery.

“I’m hoping that something with unemployment comes through in the next few months — that allows me to kind of recover and get myself at least back in the black,” he said.

Bram Sable-Smith

Coburn Dukehart

The nonprofit Wisconsin Center for Investigative Journalism collaborates with Wisconsin Public Radio, Wisconsin Public Television, other news media and the UW-Madison School of Journalism and Mass Communication. All works created, published, posted or disseminated by the Center do not necessarily reflect the views or opinions of UW-Madison or any of its affiliates.