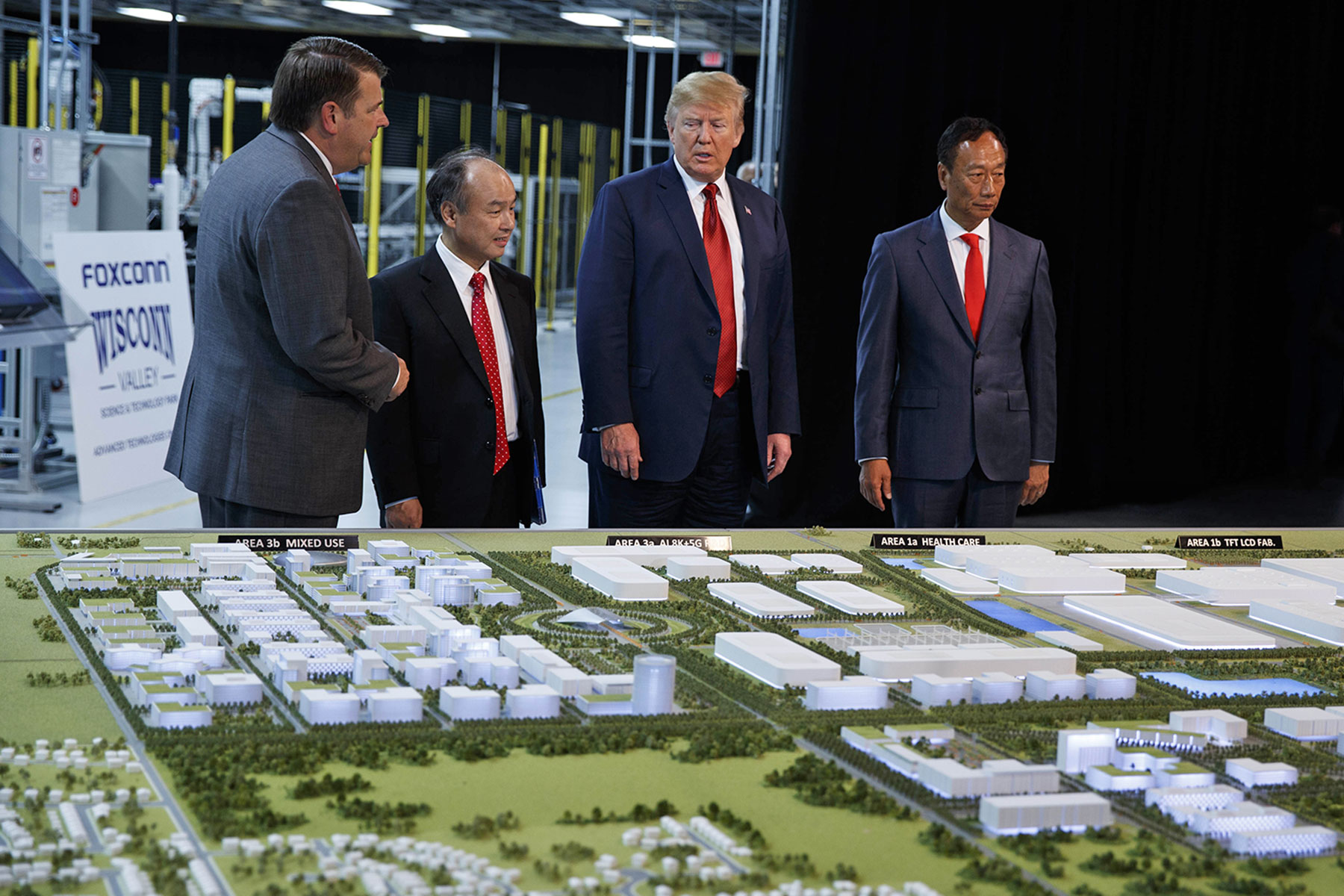

September 18 marked the one-year anniversary of the bill authorizing massive subsidies for a Foxconn plant in southeast Wisconsin. Although we still don’t know many specifics about the plant that will be built and the new jobs that will result, we have learned a lot in the last year, and the current picture is considerably different than what we had been led to believe a year ago.

Here are eight significant things we have learned since the Governor pushed the huge subsidies through the legislature in great haste last year:

1) The plant will be very different from what the Walker administration and Foxconn described to legislators and the public a year ago. – A year ago, Hon Hai Precision (Foxconn) was planning to construct a 21.5-million square foot manufacturing complex (“big enough to hold 11 Lambeau Fields”) for the production of Generation 10.5 LCD screens using thin-film transistor fabrication. The contract signed by state and Foxconn officials incorporates this plan in its description of the Project. The Gen 10.5 plants are the largest and most expensive in the display industry, producing very large panels, such as 65- or 75-inch television screens. The glass for such large panels must be manufactured at or near a Gen 10.5 plant to hold down transportation costs.

Foxconn was unable to lure a manufacturer of the large glass screens to the Racine area, where such a facility would have cost an additional $1 billion or more. As a result of this, as well as market forces, Foxconn recently acknowledged that it would first build a much smaller Generation 6 plant, to manufacture smaller display panels cut from smaller pieces of glass. The Gen 6 plant has a much smaller footprint and is far more automated than the Gen 10.5 plant, employing fewer people overall and fewer lower-skilled workers.

2) Economic forces make Foxconn plans much more fluid than most people anticipated. – The changes in the Foxconn plans that emerged over the last month or two illustrate that Foxconn must adjust to shifting economic circumstances. That should come as no surprise to anyone, but it flies in the face of the types of concrete assurances state and corporate officials were making in 2017 about Foxconn’s intentions.

The recently announced changes also illustrate that Foxconn’s assurances about its plans should not be relied on. After a newspaper reported in May that the corporation would build a smaller Wisconsin plant than initially planned, Foxconn representatives flatly denied that for a couple months before finally conceding that the story was correct.

3) The total subsidies for Foxconn are much greater than the $3 billion that lawmakers focused on during debate on the bill. – Foxconn will receive direct payments for 15% of their costs of construction and 17% of their costs of payroll for individuals’ pay up to $100,000, provided the company meets certain benchmarks in the number of people employed and the average wage per employee. These subsidies (not tax refunds, because Foxconn will pay virtually no tax under Wisconsin law) could amount to $2.85 billion over the course of the 15-year contract.

Foxconn is also receiving a variety of other assistance from the state and local governments. A January 4, 2018 Legislative Fiscal Bureau memo estimated this assistance could increase the total subsidies by more than $1.6 billion dollars, or almost 57%:

- Local Government Assistance $763.8 million

- Expedited I-94 Project (plus debt service) $408.3 million

- Utility Costs $140 million

- Sales and Use Tax Exemption $139 million

- State and Local Road Improvements $134 million

- DWD Worker Training and Employment $20 million

- Grants to Local Governments $15 million

- Economic Development Liaison $361,000

Total Additional Costs: $1,620,461,000

The Foxconn legislation also creates a large potential cost for state and local governments. It authorizes municipalities to issue Tax Incremental Financing (TIF) revenue bonds, backed by the Department of Administration’s “moral obligation” pledge, to finance the costs related to development occurring in or for the benefit of the Foxconn manufacturing zone. If the revenues from the TIF districts fall short of the amount needed to cover the cost of the bond and interest, the state would be on the hook for up to 40% of the shortfall. The Village of Mount Pleasant has issued such TIF revenue bonds. Both Racine County and the Village of Mount Pleasant have had their bond ratings downgraded since taking on debt to finance improvements on behalf of Foxconn.

4) The changes in Foxconn’s plans are likely to increase the cost of the subsidies per job created. – The recently announced changes in Foxconn’s plans put more emphasis on automation and make it less likely that Foxconn will hire 13,000 people at the new plant. In that case, the total amount of subsidies could be less than previously anticipated, but the subsidy per job created would be even higher because some of the subsidies aren’t tied to achieving the employment target. For example, if Foxconn creates 13,000 jobs paying an average of $54,000 per job, the cost of the new state tax credits will be $219,000 per job, not counting as much as $124,000 per job for other state and local subsidies. But if Foxconn’s employment in Wisconsin tops out at 10,400 jobs initially paying an average of $56,000 per year (and if compensation increases 1.5% per year), the cost of the tax credits for each job will be $274,000, plus an additional $156,000 more per job for the other subsidies.

5) Whether the state and local governments eventually recover their subsidies remains unclear at best. – Even under the optimistic growth and employment scenarios laid out by Foxconn last year, it appeared that it would take at least 25 years of high levels of employment for the state to recoup the $2.85 billion cost of the new tax credits. The recently announced changes could potentially reduce the expenditures for those subsidies, but they will probably reduce the offsetting revenue collection even more – lengthening the time it will take to get a positive return on the huge expenditures.

For the same sorts of reasons that Foxconn’s plans have changed significantly in the last couple of months, the company’s future path will also change. In a field where technology is evolving so quickly, the Foxconn plant could easily become obsolete and the corporation might pull up stakes long before the new tax revenue offsets the costs of state and local subsidies. That risk will increase when the state cash payments end in 2032, since the economics of the plant seem to be dependent upon huge subsidies. A Foxconn exit at that point would almost certainly be well before the state and local governments can recoup the costs of those subsidies.

6) The billions of dollars allotted to Foxconn subsidies could produce far more jobs through other investments. – In the rush to pass the Foxconn legislation a year ago, legislators had no opportunity to consider and debate other potential uses of the billions of dollars slated to be used for the benefit of one employer. In a commentary released in May 2018, two economists – William Holahan, the former chair of the UW-Milwaukee Dept. of Economics, and Charles Kroncke, former professor and Dean of Business at UW-Madison – estimated that using the same amount of money for other subsidies would generate about 90,000 jobs instead of 13,000. Taking that lost opportunity into account, they concluded that the Foxconn deal will be a job loser for the state.

7) Awarding large subsidies to specific employers is a fiscally hazardous practice because it’s a slippery slope. – Some people foresaw this lesson, but the proposals this year to extend similar subsidies to Kimberly Clark make it clear that granting huge subsidies to a foreign corporation will make it very difficult for state policymakers to refuse to give comparable subsidies to Wisconsin-based corporations that claim to need that assistance to create or maintain jobs in the state. The bill the Assembly passed to help Kimberly Clark even went a step further by authorizing comparable subsidies for merely limiting the jobs cuts to 7% of the company’s local workers. The fiscal peril of facing numerous demands for similar subsidies should have been obvious to lawmakers a year ago when they succumbed to pressure to add a $12.5 million subsidy for Fiserv to the Foxconn bill, after that local corporation suggested it might move its headquarters. (Less than a year later, Fiserv announced it is buying the naming rights to the new Milwaukee Bucks arena, belying the company’s claim to need subsidies.)

8) The prospects for helping the Milwaukee area’s low-wage workers appear more remote. – One of the selling points for the Foxconn legislation was that the new plant would be a source of employment for low-wage workers in the Milwaukee area. The Department of Workforce Development touted the “transformational opportunity” of Foxconn for “those in the minority community facing barriers, particularly in the Milwaukee area.” Conservative commentator Mark Belling opined, “Milwaukee and Racine continue to have persistent problems of underemployment because many workers lack skills for higher-end jobs. Many of the positions Foxconn will create will be perfect for these people.” As recently as May of this year, a business reporter for the Milwaukee Journal-Sentinel wrote that there would be jobs for “thousands of people who arrive at its gates with no special skills and no more education than a high school diploma.”

That employment scenario now seems considerably less likely, based on the changes in the type of plant that will be built. In an August 23 interview, a Foxconn representative said that the change of plans from a Gen 10.5 to a Gen 6 plant would significantly change the mix of employees. While the initial projections anticipated that 75% of the employees would be assembly workers and 25% engineers, Foxconn now projects an employee mix of 90% engineers, including sales and marketing employees, and fewer than 10% assembly workers.

In short, much has changed over the past year, and it is now clear that the proponents of the huge Foxconn subsidies package relied on flawed assumptions for the original sales pitch. Now that we can see that Foxconn’s plans are far more fluid than originally presented, we should not be surprised if Foxconn asks the state to renegotiate parts of the deal. If or when that happens, state and local policymakers need to be far more careful and deliberative than they were when proponents of the massive subsidy package rushed it through the legislature a year ago.

Jon Peacock and Joanne Brown

Originally published on wisconsinbudgetproject.org

Help support the Wisconsin Budget Project with a donation. The organization is engaged in analysis and education on state budget and tax issues, particularly those relating to low-income families. It seeks to broaden the debate on budget and tax policy through public education and by encouraging civic engagement on these issues.