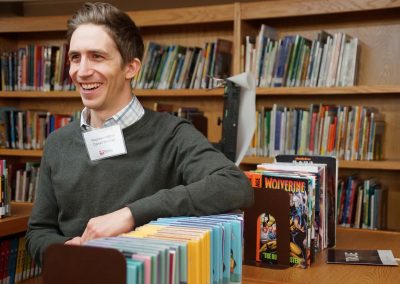

Milwaukee Public Schools (MPS) hosted a special celebration at Victory Italian Immersion School on May 8, where its entire class of fifth-grade students had completed the EVERFI program sponsored by Educators Credit Union (ECU).

EVERFI is a financial literacy tool that teaches students about saving money, planning for college, and protecting personal information. The program aligns with the State of Wisconsin’s requirement for financial literacy education.

“Financial literacy is a skill that everyone needs regardless of their future plans,” said Linda Hoover, CEO and President of ECU. “Since most people are not learning it at home, we believe it’s imperative to bring financial literacy lessons to the communities we serve. Our goal is to reach kids at a young age, before they have the opportunity to make a bad financial decision.”

The program puts students into a digital and interactive environment where they learn lessons by stopping at different sections of a map. They then take a test to show their growth after progressing through the program.

“Financial literacy is important to our students in Milwaukee Public Schools, because it allows them an opportunity to know and understand the importance of money,” said Dr. Jeremiah Holiday, Chief Academic Officer for MPS. “It helps them to understand budgeting, and the importance of having math classes to learn a lifelong skill. Our students need these tools as they become self-sustaining adults in our 21st Century society.”

Educators Credit Union is now sponsoring the EVERFI financial literacy program in all MPS elementary schools, which will impact thousands of students. The program is integrated into the elementary curriculum to teach students about the importance of smart money management.

“Financial empowerment is the great equalizer. By engaging students early we are laying a solid foundation for future life and financial lessons,” said Victor Frasher, director of community engagement for ECU.

Some of those lifelong skills are applied when dealing with a simple contract, for example. It require reading comprehension and understanding of the dollar amount. As students go on to have their own families and make big purchases like homes and cars, they need to understand about their budget and savings. That enables them to operate within their means, and not beyond of it.

“The partnership with MPS and EVERFI is very important. It allows us to offer real life experiences for students outside the classroom to prepare them for adult situations,” added Dr. Holiday. “Such collaboration is vital to the life of our schools and our community. So this is huge for us, because the school district wants to develop a new generation leaders with this kind of education.”

Over the course of the online, interactive program, students learn about fundamental financial lessons, like saving money, the differences between credit and debit, and planning for the cost of college.

“EVERFI is important for the students because it gets them to start thinking about financial literacy before they’re actually making real financial decisions. It gives them real context for how money works in the world,” said Rita DeFilippis, a teacher at Victory School. “I hope that the students learned to prepare for their future. Whether it’s college planning, saving or investing, or just having more of a sense on how money operates.”

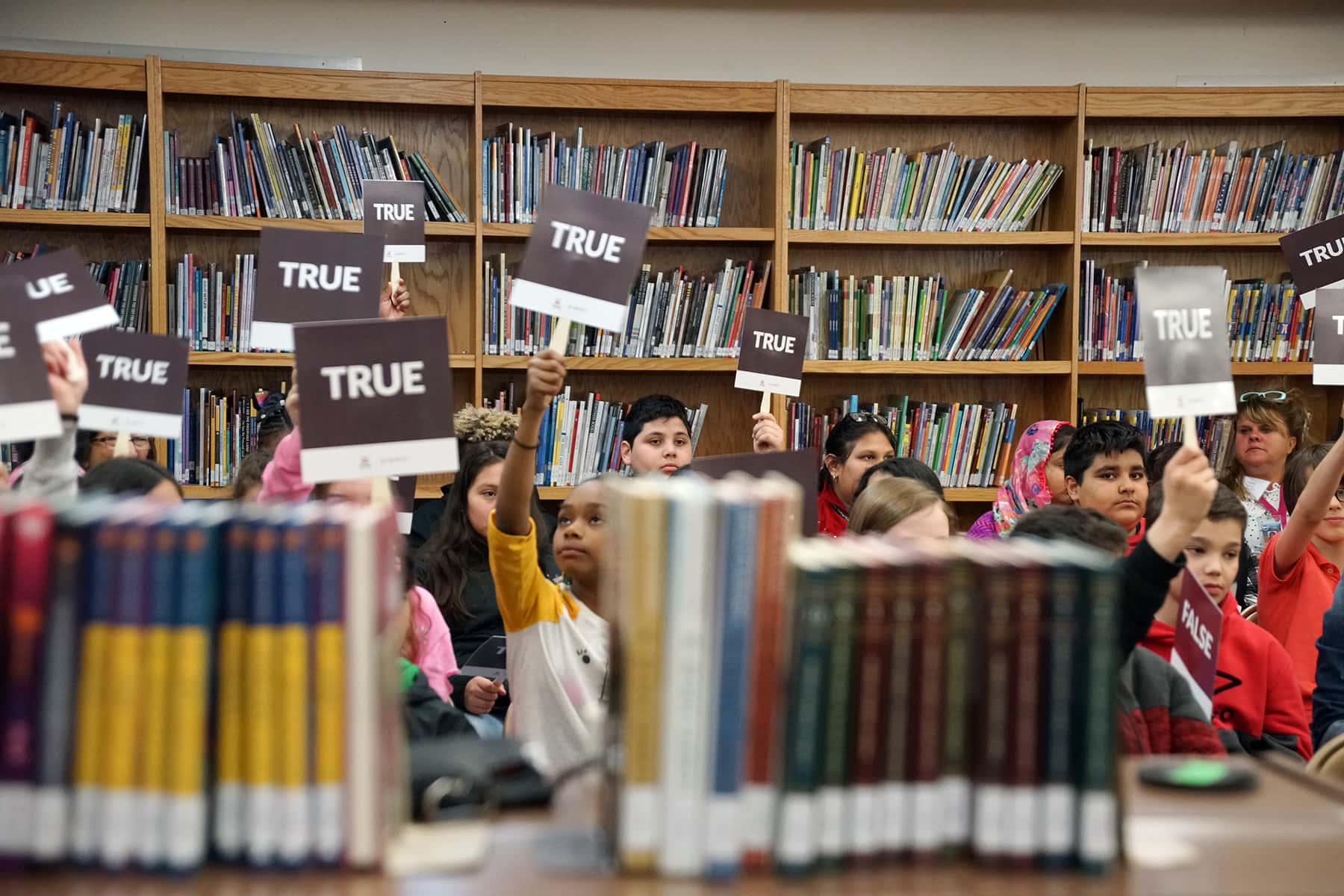

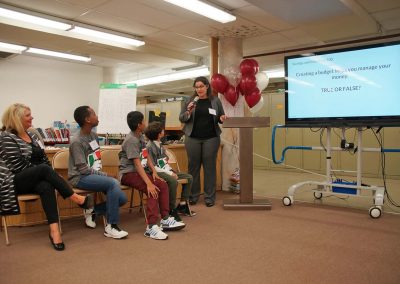

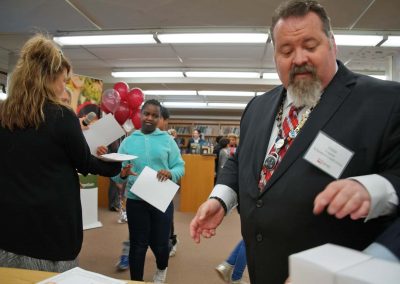

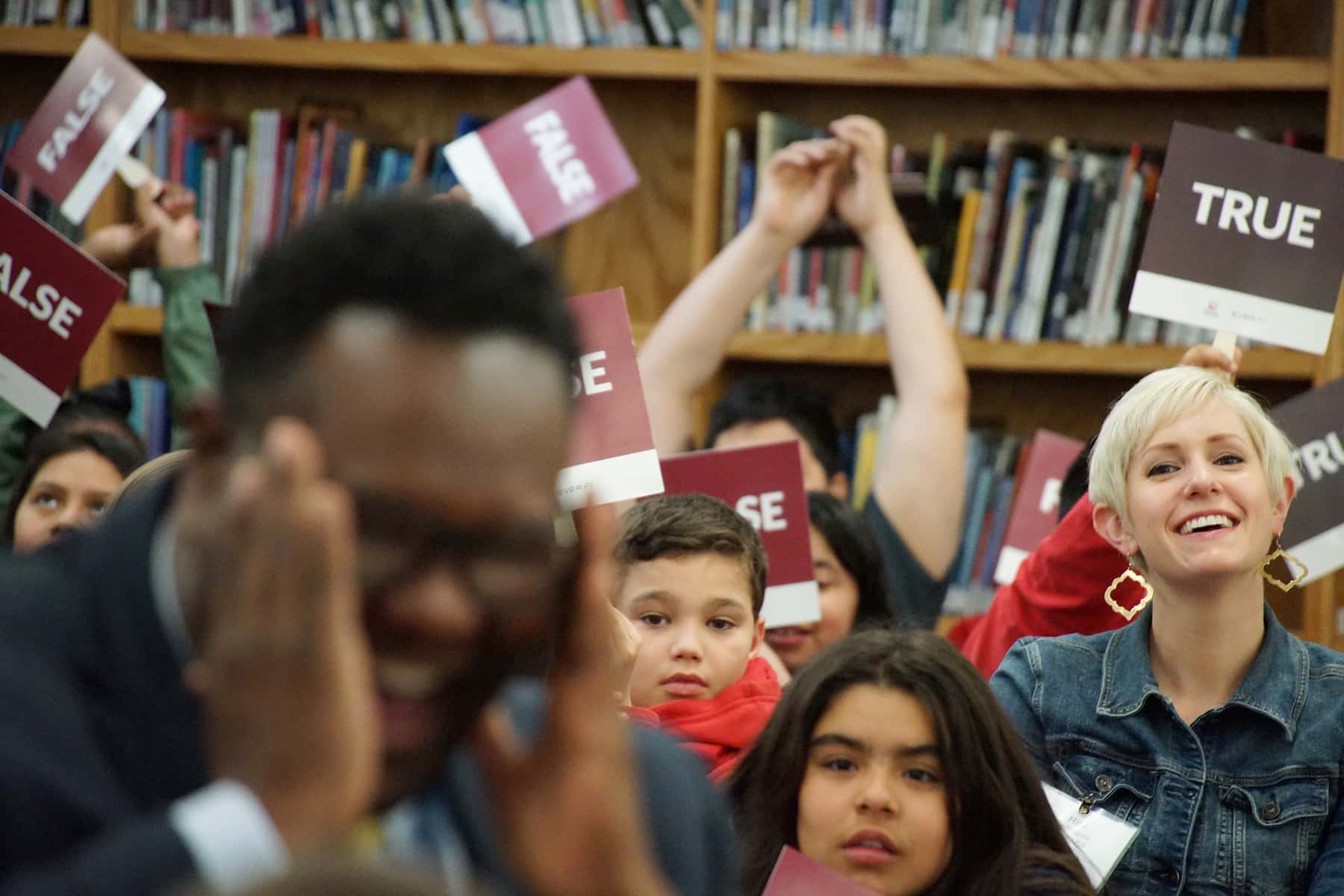

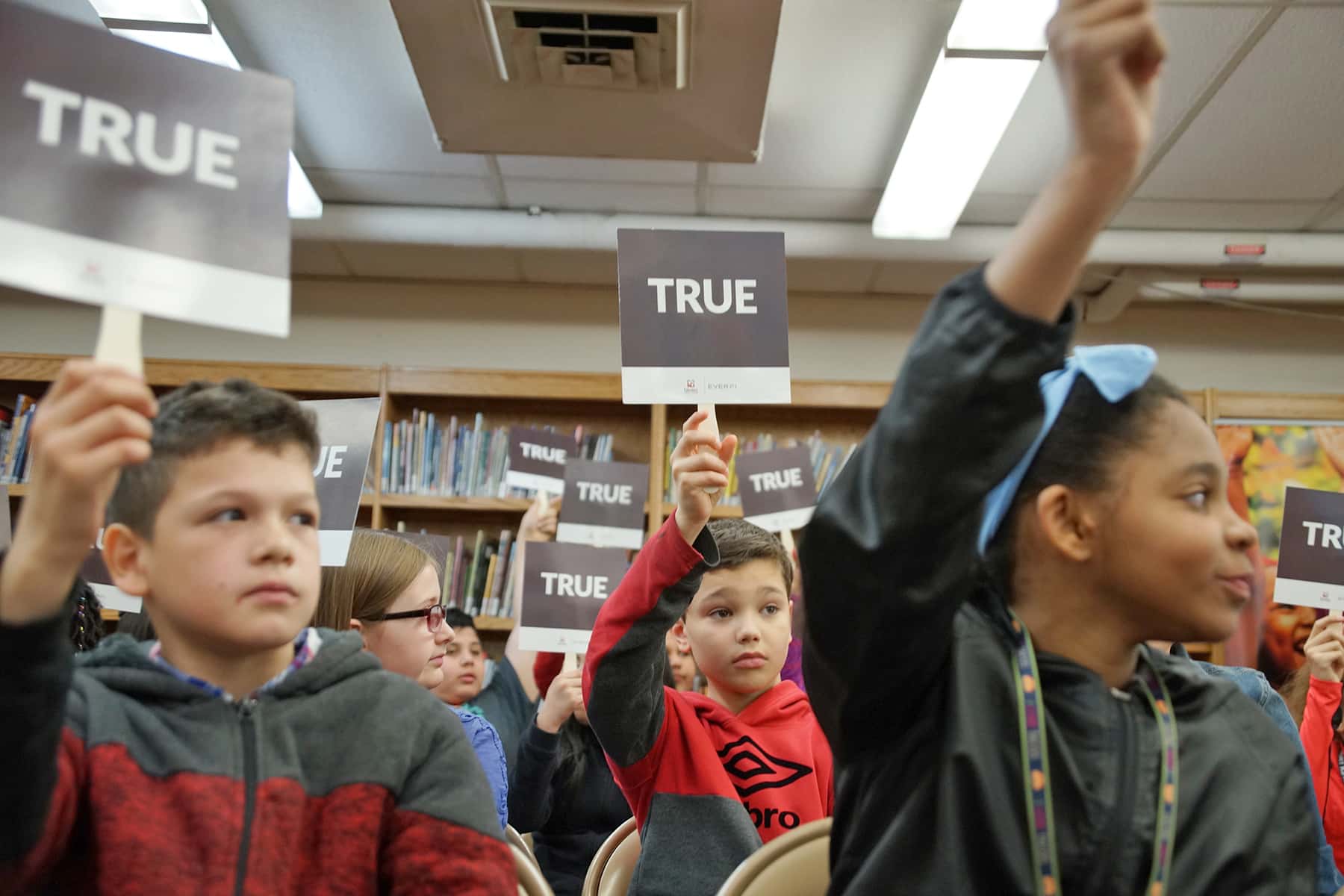

As part of the celebration event, every Victory School fifth grader received their certification for passing the EVERFI Vault program. Some of the students took on the MPS Chief Academic Officer in a quiz show-like “True or False” challenge that put their knowledge to the test.

“ECU has deep roots in education, and has seen what happens when people don’t get financial literacy – like when they apply for loans or have struggles with checking and savings accounts,” added Frasher. “So we really feel that it’s important to get them at a young age, and make sure these programs are available for teachers to support their existing curriculum.”

EVERFI is the leading education technology company that provides learners of all ages with education for the real world, through innovative digital learning. EVERFI also powers community focused financial education for 750 financial institutions across the country.

“It has taught me how to use a budget and manage my money. So when I get older I know what I can do with my money, to plan and save for other stuff. Some parts of the program were hard, but I think it prepared me better for my future,” said Mateo Corral, student at Victory School.

© Photo

Lee Matz