America has to reinvent our understanding of economics after 40 years of living under a tax-cutting, austerity-imposing, Republican-promoted trickle-down Reaganomics scam and return to a Keynesian system that still works in those countries like Norway, New Zealand or Denmark that never adopted “austerity.”

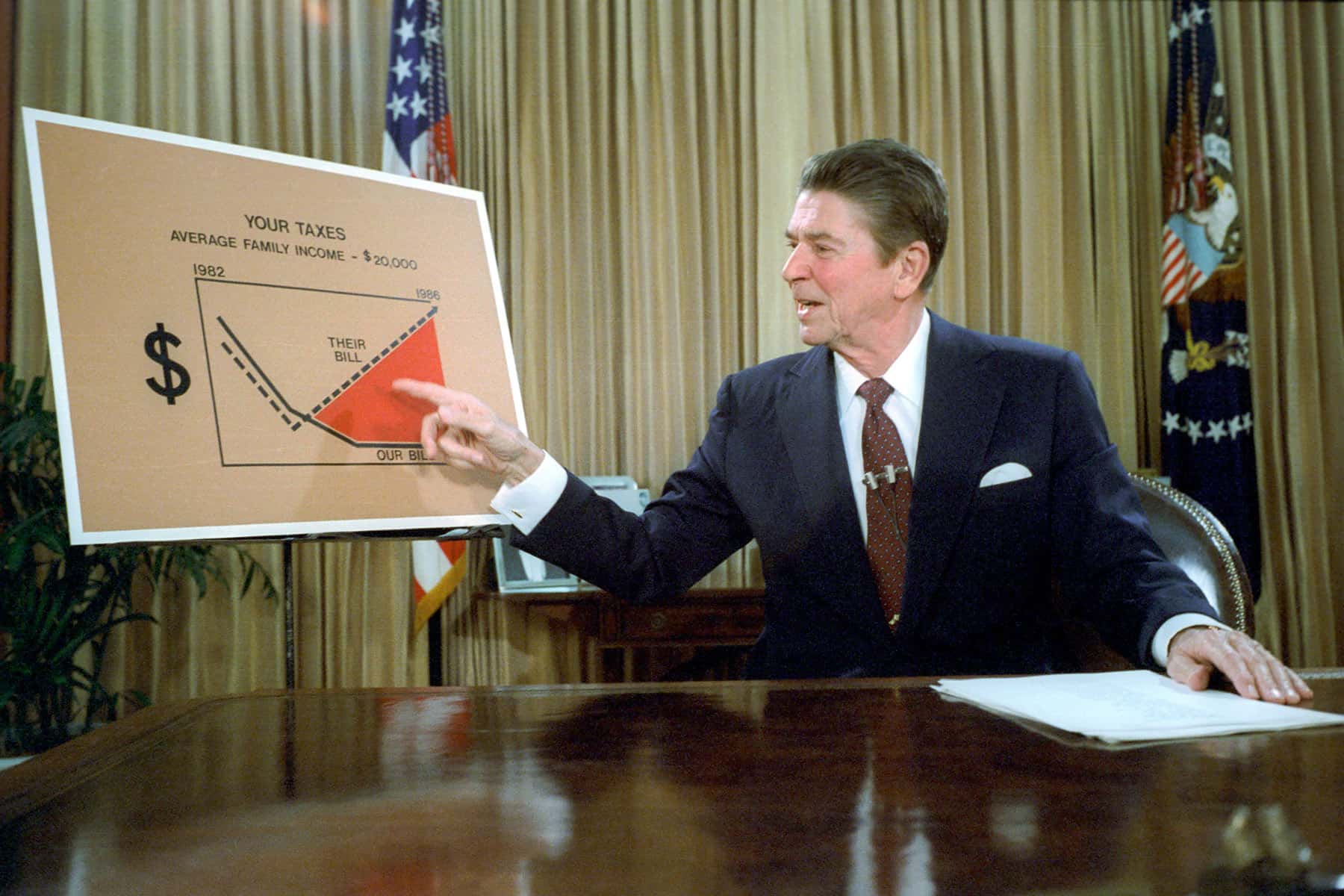

The core idea of Reaganomics is that if we give huge tax cuts and multi-billion-dollar subsidies to billionaires and giant corporations, that will “incentivize” these “job creators” to expand the economy and raise prosperity all around for everybody.

In fact, all those giant corporations and billionaires have done is put all that cash in their money bins and use it to buy 400-foot yachts and rocket rides into outer space…while destroying unions and holding down wages on working-class people.

A recent study from the London School of Economics has now totally debunked the Reaganomics notion that tax-cuts for rich people incentivize them to “create jobs” or lead to economic growth. In fact, such tax cuts only serve one single purpose: to move more of a nation’s income and wealth from the bottom 99% up into the money bins of the morbidly rich. And they do nothing whatsoever for the overall economy.

To the contrary, Reaganomics has devastated America. As a result of Reagan/Bush/Trump tax cuts, noted former Labor Secretary Robert Reich, “Since the start of the pandemic, just 651 American billionaires have gained $1 trillion of wealth. With this windfall they could send a $3,000 check to every person in America and still be as rich as they were before the pandemic.”

Reich added: “Yet at the same time, more than 20 million Americans are jobless, 8 million have fallen into poverty, 19 million are at risk of eviction and 26 million are going hungry.”

So, how did we get here, and have Republicans yet copped to this giant, 40-year-long hustle that’s still being taught in our colleges and universities by professors subsidized by rightwing billionaires?

Back in 1980 Repbulican candidate Ronald Reagan promoted trickle-down economics as a “new idea,” representing the latest, state-of-the-art thinking from billionaire-funded so-called “conservative” economists. At first, even Republican politicians recognized it as a con; in the 1980 primary, Reagan’s main opponent, patrician multimillionaire George HW Bush, called it a con job that he labeled “Voodoo Economics.”

Bush and actual economists then knew what any student of economic history knew: trickle-down was just a money-grab by Reagan, who was fronting for his patrons among the very richest Americans. And, since the Supreme Court had just (in 1976 and 1978) legalized political bribery by billionaires and corporations under the rubric of money being the same thing as “free speech” and therefore protected by the First Amendment, Reagan and his friends were all in.

But trickle-down wasn’t even a new con. Back in the 1890s it was called “Horse & Sparrow Economics,” the sales-pitch before the era of cars being that if you fed horses more oats than they could normally digest they’d drop all that undigested oat in their manure for the sparrows to pick at; rich people’s excesses would spill over to the average person. It not only didn’t work; it was blamed, in part, for the Panic of 1896.

Warren Harding revived Horse & Sparrow Economics in 1920 when he campaigned on dropping the then-91% top tax bracket down to 25%. He was elected and kept his promise, the result being the “Roaring 20s” when the rich got fabulously richer while working people saw their wages actually drop (leading to an explosion of unionization efforts by pissed-off workers that were violently suppressed by employers and police).

It all came to a startling and final end in 1929 with the Great Crash that set off what was then called the Republican Great Depression (the “Republican” part of that label largely wore off after the election of Republican President Dwight Eisenhower in 1952). Republicans stopped talking about horses and sparrows around that time, but the theory never really died; Reagan simply reinvented it in 1980 as “Supply Side Economics,” aka trickle-down.

Back in 1896 and 1929 people didn’t need a detailed multi-decade, multi-country analysis of Horse & Sparrow to know it was bad news: the Great Panic and the Republican Great Depression pretty much convinced everybody.

But somehow — even after 4 economic crashes (the Reagan stock market crash of 1987, the Bush Great Recession of 1992, the Second Bush Great Recession of 2008 and the Trump Depression of 2020) and spreading poverty — most voters never managed to put together the cause-and-effect of trickle-down Reaganomics.

This most recent study of trickle-down is probably the most comprehensive effort ever made to figure out what happens when you radically cut taxes on the morbidly rich. The researchers used “data from 18 OECD countries covering the last fifty years to investigate the effects of major tax cuts for the rich on income inequality, economic growth, and unemployment.”

And when they compiled those 50 years of data over 18 countries that had engaged in what we call Reaganomics and most of them call “austerity” economics, it wasn’t even close to what Reagan and his billionaire buddies told us would happen.

“Our results show,” the researchers wrote, that “major tax cuts for the rich increase the top 1% share of pre-tax national income in the years following the reform (𝑡+1 to 𝑡+5). The magnitude of the effect is sizeable; on average, each major reform leads to a rise in top 1% share of pre-tax national income of 0.8 percentage points.”

So the rich got richer. But did these “job creators” use any little bit of that money to, well, create jobs? “No,” say the economists at the London School of Economics.

“The results also show that economic performance, as measured by real GDP per capita and the unemployment rate, is not significantly affected by major tax cuts for the rich. The estimated effects for these variables are statistically indistinguishable from zero…”

So what is the single largest result of a nation embracing Reaganomics trickle-down austerity tax-cut policies?

“Overall,” their study summarized, “our analysis finds strong evidence that cutting taxes on the rich increases income inequality but has no effect on growth or unemployment. Our results … suggest that lower taxes on the rich encourage high earners to bargain more forcefully to increase their own compensation, at the direct expense of those lower down the income distribution.”

Americans seem to have largely figured this out: last year, for example, Arizona voters approved a ballot measure (Prop 208) that raised taxes by 3.5% on wealthy people making more than $250,000 a year. It was designed to raise $940 million a year from those taxes that would all go to fund the state’s crisis-ridden public-school system.

But when working-class people are gutted and billionaires make more billions, the stability of democracy suffers — particularly in a nation like the USA where the Supreme Court legalized political bribery in Citizens United.

Which explains why this year, when the Prop 208 tax increase on rich people was to take effect, the Republican-controlled, billionaire-funded Arizona legislature passed the largest tax cut for the rich in the state’s history.

Altogether, Arizona Republicans passed and Governor Ducey signed a $1.9 billion tax cut that, as the Prescott Valley News noted “mainly benefits the wealthy” to “shield high-earning taxpayers from the effects of a new 3.5% tax surcharge voters approved in November to boost education funding.”

Until we get money out of the body of our political system, any effort to pull these billionaire leeches off our backs will be somewhere between extremely difficult and futile.

The For The People Act goes a long way in this regard, which is why billionaire-funded groups like Freedomworks are working so hard to kill it. It explicitly requires transparency from so-called “dark money” donors and groups, an important first step toward restoring voter faith in our political system.

That is also why no Republicans in the House voted for it and Republicans in the Senate have filibustered it. They don’t want the depth of how sold-out they are to become public.

It is crucial Democrats change senate rules with their 50 votes and end the Senate filibuster so America can get this Act into law and solve our parasitic billionaire problem. And then fix the holes the GOP has bored into our tax system so billionaires pay more than the 1% to 3% most are paying (and giant corporations pay nothing) while average Americans pay an average 24.2%.

If we fail in this, our democracy will continue to crash and burn, the attacks on it funded by rightwing billionaires will increase, and more members of the working class in America will slide into poverty.

Library of Congress

© Thom Hartmann, used with permission. Originally published on The Hartmann Report as Trickle-Down Economics Isn’t Even a New Con

Subscribe to The Hartmann Report directly and read the latest views about U.S politics and other fascinating subjects seven days a week.