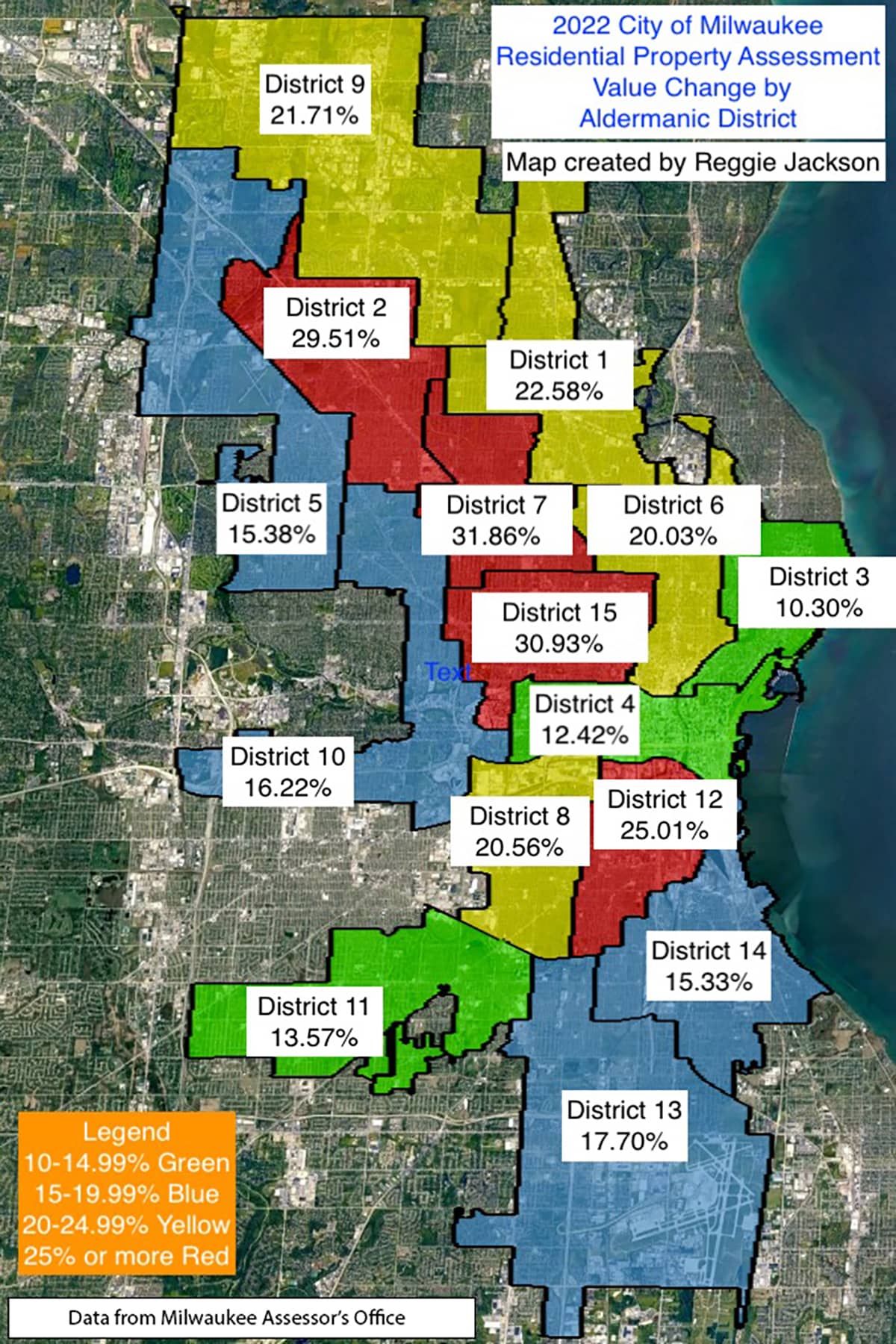

There has been little said by most elected officials about the readily apparent racial imbalance in the latest assessments of home values in Milwaukee. Overall, the city wide increase was 17.77%. By far the largest increases were in Black and Hispanic neighborhoods, which all saw increases exceeding 20%.

Residents in those areas who are very concerned about how this will impact their property taxes later this year are patiently waiting on an explanation as to why the value are so much more in Black and Hispanic parts of town.

Alderman Bob Bauman said, “There will be a flood of protests over this, an absolute flood because I can speak for a lot of my neighbors. Their incomes haven’t gone up 18%…You will be putting a substantial squeeze on the homeowners trying to hang on in some of these lower-income neighborhoods.” What he misses out on, is that his district saw the second lowest increase in the city (just 12.42%).

The increase in residential “valuations” is partially due to the fact the no assessments were done in 2021. These increases are based on two years of growth. In 2019 the median home sale price in Milwaukee was $138,000 and it increased to $172,000 by 2021. The average assessment went from $131,166 in 2021 to $154,469 in 2022.

Milwaukee Commissioner of Assessments Nicole Larsen, spoke with residents of Sherman Park in a virtual meeting in May to calm fears of higher property taxes. She told the residents that higher assessments don’t necessarily lead to higher property taxes.

The city will set a tax levy this summer and tax bills will go out near the end of the year. Larsen cautioned that not everyone will see an increase in property taxes.

“If your increase is at or below that 13.23 percent increase, you probably won’t see a tax increase.”

Looking at the data from the assessors office shows that only two aldermanic districts, (3 and 4), saw an average increase less than that amount. District 3 saw the lowest increase and district 4 was the second lowest increase. All of the other thirteen districts in the city were above the 13.23% threshold Larsen mentioned. According to her reasoning, there will probably be increases in property taxes for 86.6% of the aldermanic districts in the city.

The largest increases were in majority Black and Hispanic districts. District 7 where is 85.6% of residents of voting age were Black, saw the largest increase at 31.86%. The second largest was in district 15 where is 79.1% of residents of voting age were Black. The assessments in that district increased by 30.93%. The third largest increase was in another majority Black aldermanic district, the district formerly represented by Mayor Johnson, district 2. Seventy-three percent of the residents of voting age in the district are Black, and the assessments increased by 29.51%.

Of the districts which increased over 20%, all eight were where a majority of residents of voting age were Black or Hispanic. The other five districts with the highest increases were as follows:

- District 12 (69.6% of residents of voting age are Hispanics) assessments increased by 25.01%

- District 1 (83.3% of residents of voting age are Black) assessments increased by 22.58%

- District 9 (62.7% of residents of voting age are Hispanics) assessments increased by 21.71%

- District 8 (73.3% of residents of voting age are Hispanics) assessments increased by 20.56%

- District 6 (73.2% of residents of voting age are Black) assessments increased by 20.03%

By contrast the district with the seven lowest increases were all where White residents were over represented as compared to their 32.3% of city residents.

- District 13 (49.4% of residents of voting age are White) assessments increased by 17.70%

- District 10 (48% of residents of voting age are White) assessments increased by 16.22%

- District 5 (39.6% of residents of voting age are White) assessments increased by 15.38%

- District 14 (56.2% of residents of voting age are White) assessments increased by 15.33%

- District 11 (57.6% of residents of voting age are White) assessments increased by 13.57%

- District 4 (51.7% of residents of voting age are White) assessments increased by 12.42%

- District 3 (76.3% of residents of voting age are White) assessments increased by 10.3%

I have had several residents reach out to me with concerns about the huge increases they saw in their assessments. They are rightfully worried that there will be significant increases in the property tax bills they will receive later this year.

It is obvious that the hot housing market during the pandemic has played a role in the fact that every aldermanic district saw increases in home values. What feels very unfair to residents that saw the largest increases is that their homes are generally worth significantly less than in the districts with the lowest increases.

- District 3 assessments increased by 10.3%, the average home is assessed at $306,494

- District 4 assessments increased by 12.42%, the average home is assessed at $295,053

On the other end of the spectrum the two largest assessment increases are in districts with some of the lowest assessed value.

- District 7 assessments increased by 31.9%, the average home is assessed at $93,754

- District 15 assessments increased by 30.9%, the average home is assessed at $69,978

In the districts where Whites are primarily living, the average increase in assessed value was just 14.42%. For the heavily Hispanic districts (12 and 15) the average increase was 22.79%, 58 percent higher than their White peers in the city. For the heavily Black districts, the average increase was 26.1%, nearly double what their White peers saw.

Some would argue that the higher valuations for Blacks and Hispanics is a good thing. It means they have regained much of the value they lost in home values during the Great Recession. For those who want to sell their homes, they can ask more than they could have two years ago. However, for those not wishing to sell, they will most assuredly see a large increase in their property tax bill. However, now that interest rates have been increased dramatically, homes sales are already seeing a downward trend.

With inflation being what it is, this will add an extra burden to those lower income residents who are already dealing with record high gas prices, extremely large increases in food prices not to mention the probable increases in the cost of heating their homes when the temperatures drop again later this year.

For those who have appealed their assessment, the bottleneck to get those completed means that it will be a significant wait before they see if they are successful.

Another element that will exacerbate the housing problems in Milwaukee is that renters will definitely see large increases in what landlords charge for rent when those higher property tax bills come later in the year. Milwaukee has the second lowest Black homeownership rate of the fifty largest cities in the country. Just 27% of Blacks own their homes in the city, while 44% of Black families nationwide are homeowners. The median rent in Milwaukee is over $1,657 while the median mortgage is $1,184. It is significantly cheaper to own than to rent in Milwaukee.

From 2010 to 2020 only three aldermanic districts saw an increase in the White population percentage. District 4 (from 46.1% of residents to 51.7%), district 6 (from 10.6% of residents to 15.5%), and district 12 (from 14.8% of residents to 14.9%).

- District 4 (12.1% increase in White population)

- District 6 (46.2% increase in White population)

- District 4 (0.7% increase in White population)

The gentrification happening primarily in district 6, moving forward, will exacerbate the problem of affordability in those neighborhoods. Property values in the wards in the southern section of the district saw a majority of the growth in the White population as well as the largest increases in sale prices for homes during the pandemic.

At some point, the Black and Hispanic community will expect direct answers to their questions about the imbalance in assessments and the eventual increased property taxes.

Despite the fact that I have heard from a number of residents concerned with the impact of the new assessments and the differences based on race, the mayor and Common Council have said nothing for the most part. Aldermen Bauman made a public statement, but I was not able to find anything from any of the rest of the Common Council on this issue. I checked the news releases from each alderman on the city’s website and found nothing from any of them related to the assessment issue that so many residents are concerned about.

I hope that this is just an oversight that I could not find anything they said. Residents continue to call and ask me to look into the issue. It is not my job to do so, but I will continue to assist in any way that I can to shine a light on this issue.